Jewelry is advertised as one of the most thoughtful gifts for Christmas. That thoughtfulness isn’t often extended to insurance, however.

If you received jewelry as a Christmas gift, including an engagement ring during the holiday season, it’s now your responsibility to keep it safe. An insurance policy can help.

If you have renter’s or homeowner’s insurance, check with your insurance company to find out how much it will cost to insure your new jewelry under your policy. Home and renter’s insurance will cover things in your home that are stolen or damaged in a fire, for example, but only up to a certain dollar value — $1,000 to $15,000 of unscheduled personal property is typical. If thieves stole $25,000 worth of jewelry from your home, along with electronics and the silverware, you’re underinsured. Oftentimes a homeowners or renters insurance policy will limit coverage for a single piece of jewelry, typically covering up to $1,500. If your engagement ring is worth more than that, you’re underinsured.

To make sure your jewelry is covered to its full value, ask your insurer if you can buy an extension — also called a rider — that will cover the full value of the jewelry.

Also called “scheduled” insurance, extra scheduled jewelry insurance can be attached to an existing policy or can be separate. Scheduled jewelry insurance costs about $1 to $2 per $100 worth of jewelry per year, equating to $200 to $400 per year for $20,000 worth of jewelry.

Some insurance policies may only cover the cash value of the jewelry, and others may also promise to pay for a similar piece. For example, an engagement ring of a particular style and grade of diamonds could be covered and require the insurer to help you find a similar ring, up to a certain price. This can be helpful if the ring wasn’t worth thousands of dollars but has sentimental value, and you want to replace it with a ring of similar design.

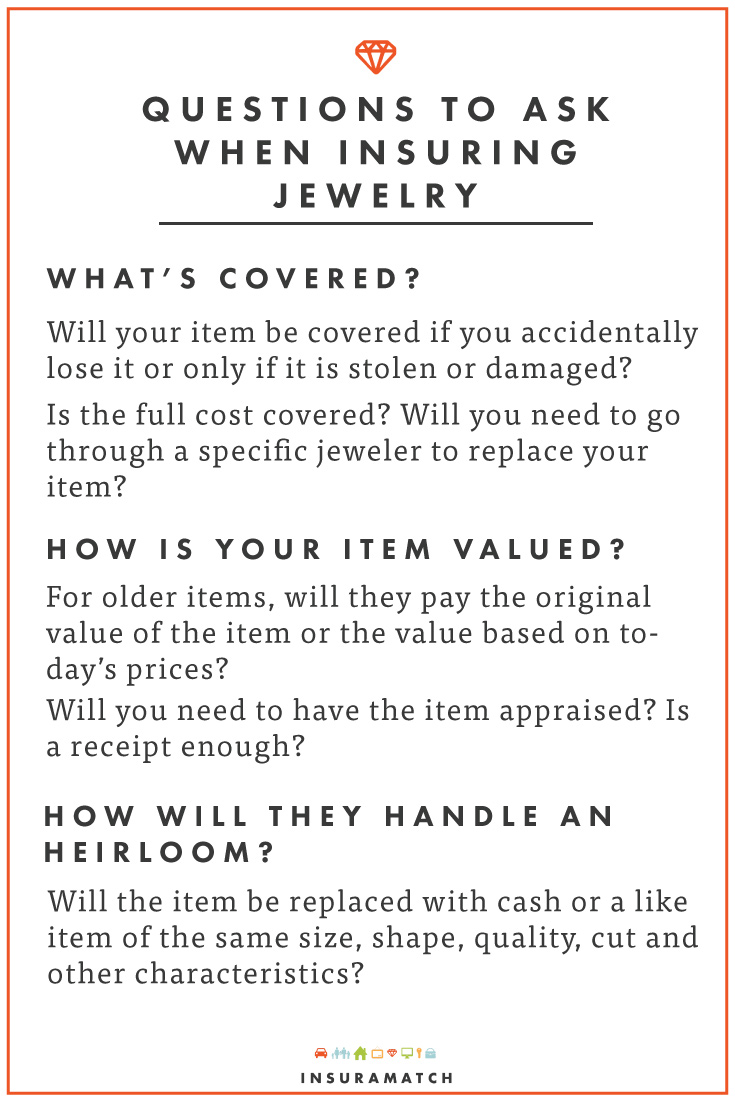

To determine the value of your insured jewelry, you’ll need to provide receipts to your insurer. This may be difficult if it’s a gift, so your next step is to hire a certified gemologist to do an appraisal. You may also need certificates — especially for diamonds — from a gemologist to prove how the diamond is graded. Photos can also help.

If you do buy a “ring rider,” make sure it’s in your name and that your main address is listed. You may move after a wedding or it may be insured at your parents’ house before the wedding, so be sure to add the ring to the insurance policy for your new home when you move in with your new spouse.

Ring insurance

If you don’t have renter’s or homeowner’s insurance, or if your insurance policy doesn’t offer enough coverage, or a rider doesn’t offer the type of coverage you want, then you may want to buy ring insurance from a company that specializes in it. They may be offered by your jeweler.

Just as you would with an insurance rider, ask the insurer if the ring is covered for accidental loss, or only if it’s stolen. Will you have to buy a replacement ring through a specified jeweler? Is the full cost covered?

If the piece of jewelry or ring is unique, such as an heirloom from a relative, ask the insurer if it will replace the item with cash or if the size, shape, quality, cut and other characteristics must be documented so a replacement can be found.

Also check if losing the jewelry is covered. What if you’re at the beach and you lose a ring in the sand? Or if it falls down the garbage disposal at home?

If the price of gold has quadrupled since your ring was bought 10 years ago, will the insurer pay the original value or will the ring’s value be based on today’s prices?

To keep the costs down for jewelry insurance, keep it in a safe or vault when you’re not wearing it. Also keep the receipts and appraisals in a safe, and give copies to your insurance company.

If jewelry is part of your homeowner’s insurance policy, consider increasing the deductible to lower the premium.

If you’re still on the fence about buying jewelry insurance because you don’t want to turn a romantic gift into another insurance bill, consider this fact from the Insurance Information Institute: In 2012 the highest percentage of homeowner’s insurance claims were made for jewelry. You’re more likely to file an insurance claim for a jewelry loss than you are for damage to your home.

Aaron Crowe is a freelance journalist who covers insurance and personal finance for a variety of websites, including his website CashSmarter.com.

customers

customers