Congratulations! Moving is a big deal, and I know you have a lot going on. However, don’t let being protected slip your mind! As you look for new places, celebrate, or prepare for a move, consider what you’ll have to do about insurance. It’s true your homeowners insurance, renters insurance, or moving company can offer you coverage, but this coverage is limited. Make sure that your furniture and valuables are protected. Be aware of any changes that may occur to your existing insurance policy and rates. Call your agent to figure out your insurance situation before you  move.

move.

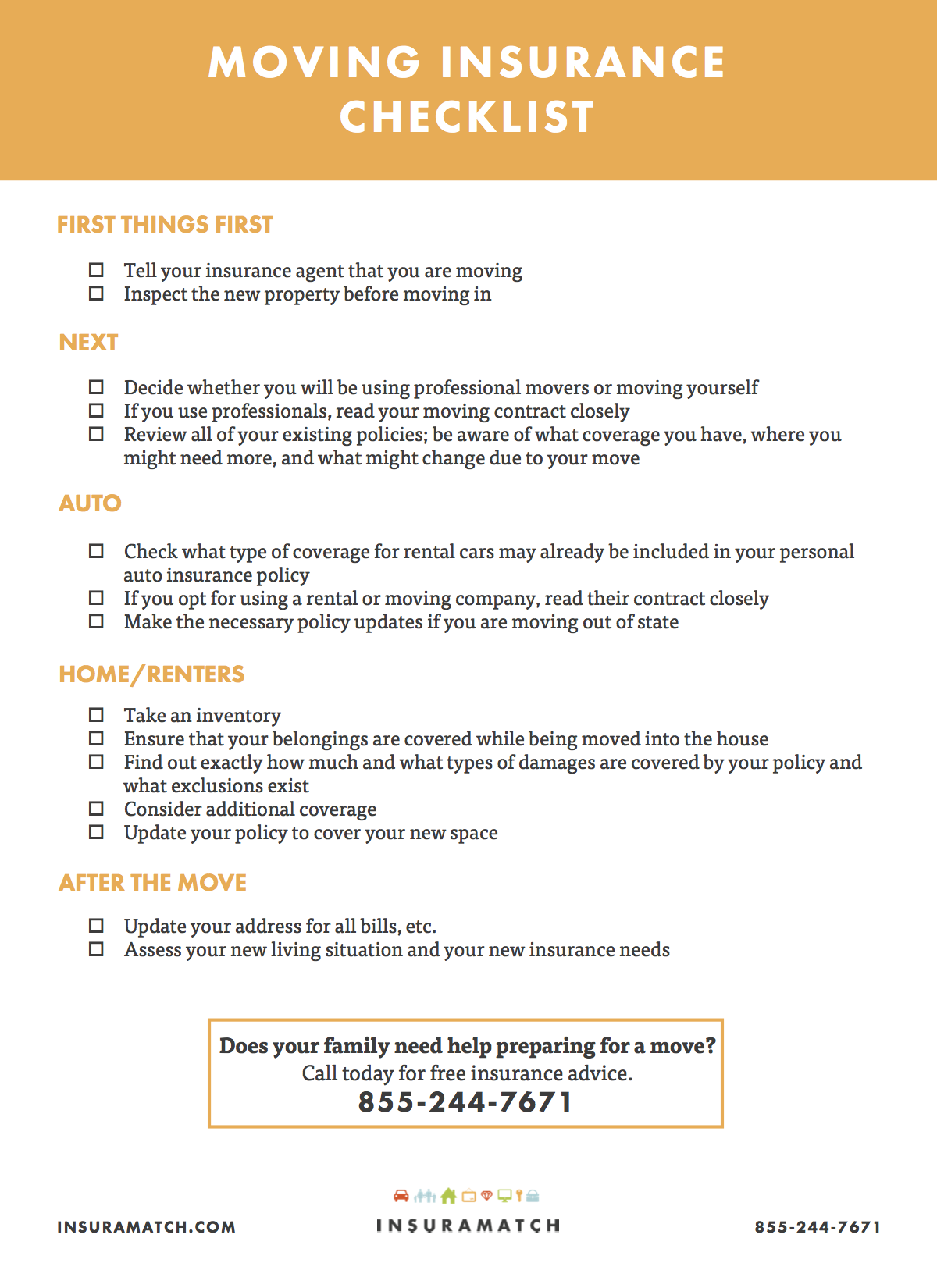

We've created a Moving Insurance Checklist to help you figure out where to start when reviewing your coverage and to give you a couple talking points to discuss with your agent. Preparing for a move is busy work, but with this checklist you will feel confident in completing the process. Keep reading for more advice, details about, and considerations for moving and insurance.

BEFORE OFFICIALLY SIGNING OFF ON A NEW PLACE

Inspect the property for safety hazards or existing damage to discuss with your real estate agent or landlord. Check the electrical outlets, lighting, ceiling fans, appliances, water, etc. Check for the ceilings and floors for molding or water damage. Check for signs of animal problems (i.e., mouse droppings or ant traps). Be sure the locks and any security systems work. Know your rights.

CHANGING YOUR POLICIES

Tell your agents that you are moving and give them your new information. Do you need a new agent? How do you transfer your policies to your new home? If you are moving out of state, your rates and requirements might change. You will likely need different structural coverage for your new home. Make sure you do not have a break in coverage by giving your agent details about when exactly you plan to move. This way you can make any necessary changes and best protect your assets and belongings.

PROFESSIONAL MOVERS OR DIY?

Decide whether you will be hiring movers, renting a moving vehicle, or moving all on your own. There is no definite, best option; pick the one that is feasible for you. You should evaluate your existing insurance coverage, consider purchasing additional coverage, take an inventory, and look into temporary storage.

PROTECTING YOU AND YOUR BELONGINGS WHEN THEY’RE ON THE ROAD

Ensure that your belongings are covered while on the road to your new place. What are your renter or homeowner policy’s restrictions and limits? According to this Household Tips Guide, usually only 10% of your property is covered under home and renters policies while in transit. How many valuable items are you moving? Whether you use professional movers or opt for a DIY move, be sure to understand the liability coverage in case there are damages to your furniture or place during the move.

According to director of personal lines policy at the Property Casualty Insurers Association of America, Chris Hackett: your auto, homeowners, or renters insurance will cover rental trucks and hired moving companies. However, you need to be aware of the different ways that they cover accidents and damaged property; rental truck or moving companies may have policies that significantly differ from yours. For example, coverage of personal property items might change if you are moving over a period of multiple days. See if your rental truck company has insurance and what it covers, and see if your auto insurance will cover costs if you are the one at fault for an accident.

Generally, moving companies will automatically provide valuation coverage, but not insurance. They may offer complete value protection, assessed value protection, and/or declared value protection based on weight. Complete value protection will cover any damaged, lost, or destroyed property, repairs and replacement—with a catch. Be aware of deductibles and the minimum coverage amounts. Assessed value protection may be good for you if your property is valuable and does not weigh much because it is based on cost. With assessed value protection, for a set cost you can purchase protection per a specific worth of value. Declared value protection based on weight coverage means that if your property is damaged or destroyed, your moving co is liable for the total weight of your property multiplied by a specified amount per pound. Complicated? Checkout this guide again for more details.

WHAT ABOUT HOMEOWNERS & RENTERS COVERAGE?

Take an inventory. Ensure that your belongings are covered while being moved into the house or in storage. Find out exactly how much and what types of damages are covered by your policy and what exclusions exist. Make the necessary policy updates if you are moving out of state.

It is likely that your homeowners insurance will not pay for any damage done to personal property while the movers are physically moving it into your new home. Sometimes this differs for the movement of specialty, high-value items. You may consider purchasing stand-alone insurance for items or valuables of great importance to you.

Renters insurance can cover your belongings and offer liability coverage. You should look for what types of damages are covered and by how much under your policy. Check for any exclusions and consider additional coverage. Ask your agent if damages that movers cause are covered and get informed on your policies specifics regarding damage or loss of items when they are not in your residence. Some insurers will not protect your property once it is out your door.

If you are worried about limited coverage, consider additional moving insurance that covers your property during movement into the rental truck, transit, and from the truck into your new home.

UMBRELLA & OTHER SUPPLEMENTAL INSURANCE

Ask about supplemental insurance. Moving companies are required to offer supplemental insurance, which covers a set percentage of replacement costs. Umbrella insurance policies can help in any emergency case by protecting your liability through additional coverage.

AFTER THE MOVE

Update your address for all bills, IDs, etc. Assess your new living situation and your new insurance needs. While unpacking, check for any damages you may have missed and be aware of deadlines for filing a claim. Change your locks. Make sure that all of your financial and insurance institutions have your new address and information. It is possible that your auto or homeowner premiums could be lower if you will be driving less, living in a particular community, or have new security or alarm systems. Last but not least, throw a house warming party and enjoy your new place!

MAKE SURE YOU HAVE THE RIGHT INSURANCE FOR YOUR MOVE. CALL 855-244-7671 TO SPEAK WITH YOUR INSURAMATCH AGENT OR TO GET A FREE RENTERS INSURANCE OR AUTO INSURANCE QUOTE!

Sources:

https://www.statefarm.com/simple-insights/residence/moving-dont-forget-to-make-insurance-changes-too

https://household-tips.thefuntimesguide.com/moving_insurance/

http://www.iii.org/article/getting-right-insurance-coverage-moving